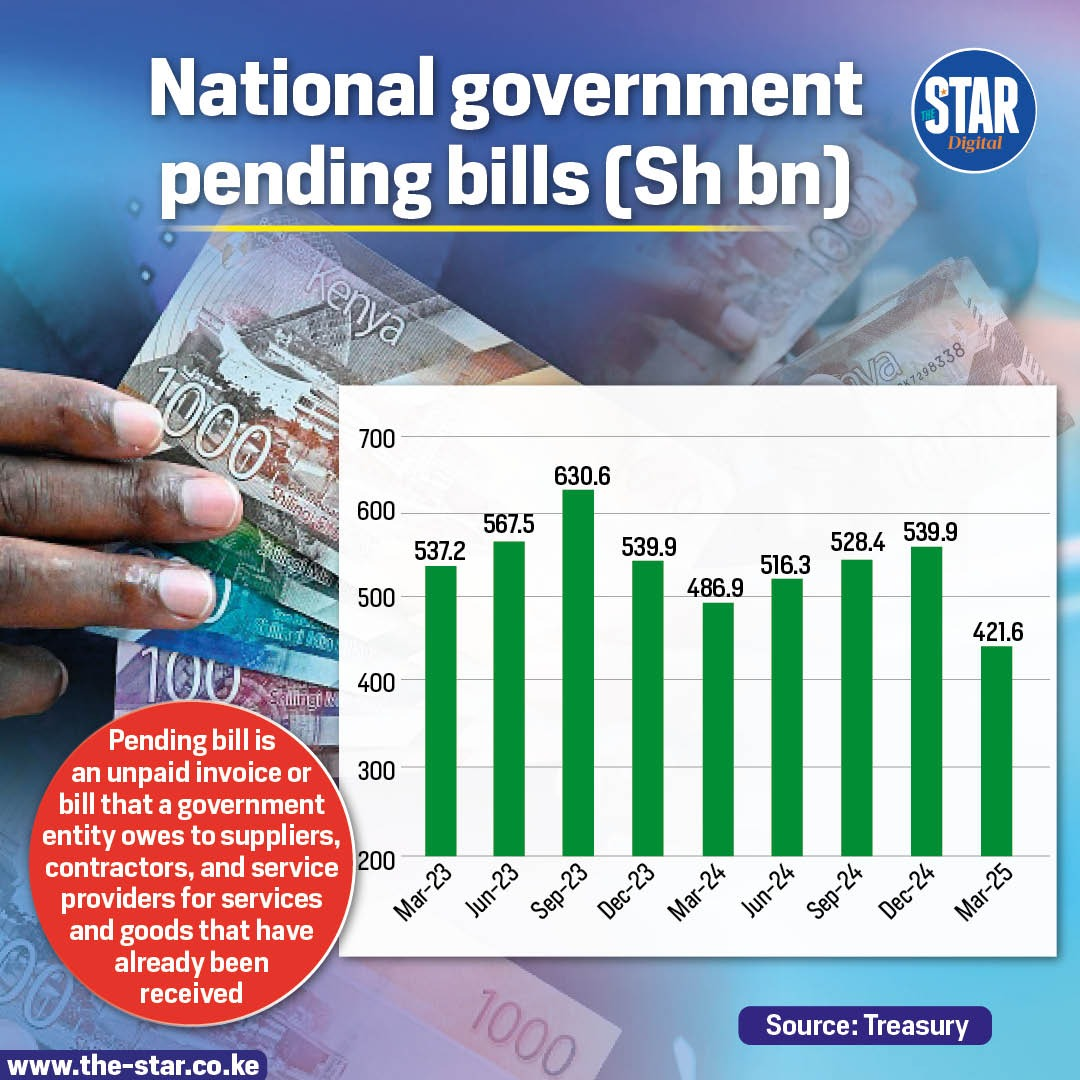

The current stock of pending bills in Kenya remains a significant challenge, with the total amount owed by the national government reaching KSh. 528.36 billion as of September 30, 2024, an increase from Kshs. 516.27 billion in June 2024.

A significant portion of these pending bills (78%) are owed by State Corporations, State-Owned Enterprises (SOEs), and Semi-Autonomous Government Agencies (SAGAs), totaling Kshs. 410.69 billion, while Ministries, Departments, and Agencies (MDAs) account for the remaining 22% (Kshs. 117.67 billion).

The government has taken steps to address this issue by establishing the Pending Bills Verification Committee, which is currently reviewing 94,996 claims valued at KSh. 571.63 billion.

The clearance strategy involves a phased approach over five years, beginning in FY 2025/26, using a mix of budget allocations, securitization

through Treasury bonds, and negotiations to reduce penalties on delayed payments.

Additionally, the government aims to strengthen enforcement of public finance regulations to prevent further accumulation of arrears.

The accumulation of pending bills in Kenya has severely impacted the private sector&

liquidity, particularly affecting micro and small enterprises (MSEs) that rely on government contracts.

These businesses struggle to access credit, leading to closures and job losses. Delayed payments have slowed economic growth, stalled infrastructure projects, and public investments, exacerbating poverty and unemployment.

This has also strained essential public services like education, healthcare, and security, while affecting government creditworthiness, resulting in higher borrowing costs and reduced investor confidence.

Without timely intervention, the economic impact will worsen, making the success of the five-year clearance plan critical to restoring economic confidence and ensuring the well-being of businesses, employees, and essential services.

The outlook for Kenya’s pending bills remains concerning despite ongoing government efforts to address the issue.

With pending bills reaching Kshs. 528.36 billion as of September 2024, and a significant portion (78%) owed by State Corporations and SOEs, the risk of further accumulation remains high.

The government five-year clearance strategy, starting in FY 2025/26, is a step in the right direction, but its success will depend on strict fiscal discipline, improved revenue collection, and enhanced public financial management reforms.

To ensure sustainable financial management and prevent future accumulation of pending bills, the government should adopt a multi-pronged approach.

First, SOEs and Semi- Autonomous Government Agencies should prioritize pending bills in budget allocations, ensuring that verified arrears are addressed before new expenditures.

This is in accordance with the PFM Act 2012 which mandates that pending bills shall be the first charge on the consolidated fund.

Secondly, Implementing an accrual-based accounting system will enhance the management of pending bills as it will require pending bills at each reporting period to be recognized in the balance sheet, this therefore will make it possible to apply the law of first charge of the budget to pending bills.

Third, explore innovative financing solutions like issuing Treasury bonds to settle long-standing debts and offsetting tax obligations for businesses owed money by the government.

Fourth, strengthen the enforcement of the Public Procurement and Disposal Act to ensure contracts are only awarded when funds are available preventing new arrears.

Finally, establish a legal framework for timely payments with penalties for non-compliance and adopt a digital tracking system for government expenditures through the Integrated Financial

Management Information System (IFMIS) for efficient and transparent payment processing.

If these measures are effectively implemented, Kenya can gradually eliminate its pending bills crisis, restore investor and business

confidence, and promote sustainable economic growth.

— ✍️ Written by Diana Kipeno